Carolyn Smith, John Hickman, Brett Coburn and Scott Harty, Alston and Bird, LLP

As our nation combats issues related to the COVID-19 public health emergency, Congress and federal agencies responded with new requirements and clarifications for employers. This advisory provides an overview of three new important developments:

Note: The president signed the Response Act into law March 18, 2020. Its provisions are effective no later than 15 days after the law was signed and apply to qualifying leave through Dec. 31, 2020. Federal regulatory agencies will need to clarify the precise effective date.

New paid sick and family leave requirements

The Response Act includes two separately named acts that require covered employers to provide paid leave for health and caregiving issues related to the COVID-19 public health emergency. The act also includes a tax credit to reimburse private employers for the cost of the required leave.

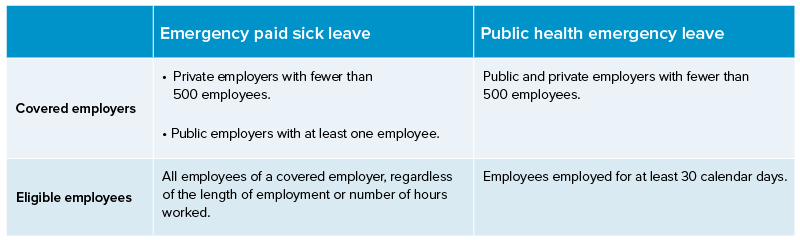

Covered employers and eligible employees

The following chart summarizes and compares “covered employers” and “eligible employees” included in the provisions of the Response Act.

Qualifying leave

An eligible employee qualifies for emergency paid sick leave if the employee is unable to work or telework for any one of the following reasons:

The circumstances that qualify eligible employees for sick leave are broader than qualifying public health emergency leave. In contrast, the only circumstance that qualifies an eligible employee for public health emergency leave is the inability to work or telework due to needing to care for their child under age 18 if their school or place of care is closed or the child care provider is unavailable due the public health emergency related to COVID-19.

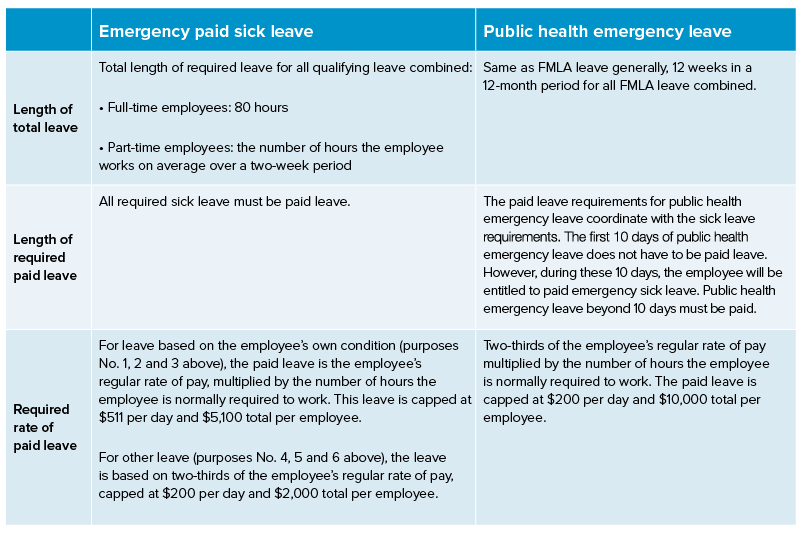

Leave requirements

The following chart summarizes and compares key portions of the leave requirements under each of the new provisions.

Special rules for certain types of employers

There are a couple of special rules for certain types of employers:

Enforcement

The DOL will enforce the new leave requirements. There is also the possibility of litigation by private plaintiffs. Failure to provide required emergency paid sick leave will be treated as a failure to pay minimum wage and can be enforced in accordance with the Fair Labor Standards Act enforcement provisions relating to minimum wage violations. That means that plaintiffs can seek to recover unpaid sick leave wages, an equal amount in liquidated damages and reasonable attorneys’ fees and costs. Unlawful retaliation is subject to the anti-retaliation provisions of the FLSA.

Because the public health emergency leave is part of the FMLA, it uses the same enforcement mechanism used under the FMLA generally, which is based on the FLSA enforcement provisions. But under the new law, employers that are subject to the public health emergency leave requirements, but do not otherwise meet the regular requirements to be a covered employer under the FMLA (i.e., employers that do not meet the normal 50-employee FMLA threshold), are not subject to a private right of action by employees for damages for a violation of the public health emergency leave requirements. Still, these employers remain subject to enforcement action by the DOL.

There are many other details. The discussion here is very high-level. There are a variety of other requirements that apply to the new leave provisions, such as notice requirements.

Employer tax credits to offset the cost of paid leave. The Response Act includes two refundable tax credits for private employers to reimburse employers for the cost of required sick and public health emergency leave. Key details include:

Major medical plans required to cover COVID-19 testing and related services without cost sharing

The Response Act requires self-funded and fully insured group health plans, regardless of employer size, and individual market plans to cover diagnostic testing for COVID-19 and certain related items and services without cost sharing, including deductibles, copayments and coinsurance. In addition to testing, plans must also cover – without cost sharing – items and services provided to a covered individual in an office visit, telehealth setting, urgent care center visit or emergency room visit that results in an order or administration of diagnostic testing. However, plans are only required to cover items or services to the extent that they relate to the furnishing or administrating of diagnostic testing or the evaluation of the individual to determine the need for diagnostic testing. This new requirement doesn’t apply to excepted benefits, such as hospital indemnity or other fixed indemnity insurance and specified disease or critical illness policies. Excepted benefits are supplemental coverage and are not intended as primary medical coverage or a substitute for such coverage.

High-deductible health plans may waive or lower deductibles for COVID-19 testing and treatment

In order to help address COVID-19 issues, many plan sponsors looked for ways to encourage employees and their families to seek necessary testing and treatment for COVID-19. One such approach is to waive otherwise applicable deductibles and copays. For sponsors of HSA-compatible HDHPs, the issue then becomes whether the waiver of the deductible will disqualify employees from HSA eligibility. The IRS provided help on this issue in Notice 2020-15. In light of the public health emergency related to COVID-19, the IRS provided that HDHPs may provide benefits associated with testing for and treatment of COVID-19 without a deductible or below the minimum required deductible for a HDHP. Thus, an individual covered by the HDHP isn’t disqualified from making contributions to their HSA merely because of the required COVID-19 benefits.

Conclusion

With Congress and federal agencies acting quickly to try to address issues related to the current public health crisis, employers will need to become aware quickly of what the new laws mean for them. Note that state laws may also apply and in some cases may impose additional requirements. Many of the details are complicated, so employers will need to consult their own advisors as to their particular situations.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and employees and other individuals should consult their own tax or legal advisers about their situation. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.