By: Carolyn Smith and John Hickman, Alston & Bird, LLP

Proposals to expand Medicare are not new, and discussions surrounding expanding Medicare eligibility have occurred at many junctures in the past. However, lately, possible Medicare eligibility expansion is gaining more attention, including in the media, as policymakers continue to grapple with perennial health care issues, such as the affordability and availability of health insurance coverage and controlling the underlying costs of health care services.

Current proposals are still in the idea stage of development, and although Congress recently held hearings to explore some of these options, no proposal is moving through the legislative process – at least not yet. Enactment of any proposal in the near term is not, and may never be, likely. However, the recent attention to these proposals raises a number of questions, one of which is: “What sort of out-of-pocket health carerelated expenses could individuals face in a single-payer health care system?”

This article provides a high-level overview of the current Medicare program and proposals to expand Medicare. It also discusses potential exposure to out-of-pocket expenses and options to help individuals plan for such expenses, including the role of supplemental health benefits.

What does Medicare look like today?

Medicare covers almost 60 million Americans, and the vast majority (85%) of individuals enrolled in Medicare qualify because they are 65 and older.

Individuals can qualify for Medicare if they are:

Medicare benefits include three parts:

Medicare offers enrollees two different ways to receive their coverage.

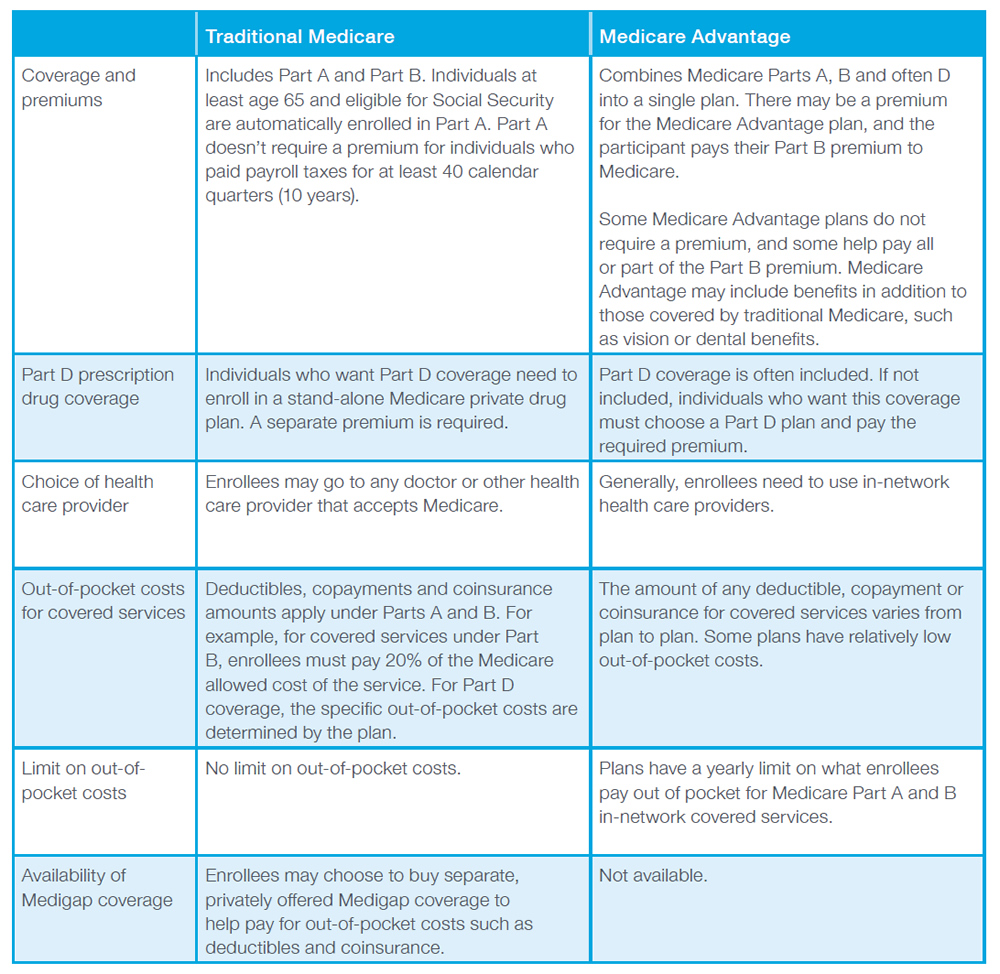

Individuals eligible for Medicare can choose between two options: (1) Traditional Medicare and (2) Medicare Advantage. Medicare Advantage plans are run by private insurers that contract with Medicare. There are significant differences between the two options and among different Medicare Advantage plans. Individuals need to consider their own personal circumstances in making their choice for coverage.

The following table provides a very high-level overview of some of the differences between Traditional Medicare and Medicare Advantage.

Medicare expansion proposals

A variety of proposals could expand Medicare eligibility or create a new public health plan option based on Medicare. Current proposals to expand Medicare (or Medicare-like plans) fall into the following three general categories. Within each category, the details of specific proposals may vary. In addition, many issues need to be resolved if any of these proposals move forward in the legislative process. For example, most proposals do not address the critical issue of how new health plan options are paid for.

The reality of out-of-pocket expenses

The practical reality is that regardless of their primary major medical health coverage, individuals face health-related out-of-pocket expenses. Some of the common circumstances that result in out-of-pocket expenses for health coverage, in addition to premiums, include:

In 2019, the Kaiser Family Foundation reported that the average out-of-pocket expense for persons in both Medicare Parts A and B in 2016 was $5,806, including medical expenses, long-term care services, and premiums for Medigap and other supplemental insurance. The Kaiser Family Foundation also recently reported that the average deductible for employer-sponsored plans is $1,573. Yet, the Federal Reserve recently reported in May 2019 that almost 40% of Americans have difficulty handling an unexpected $400 expense, either having to borrow or sell something to pay for the expense or not being able to cover the expense at all. In addition, one-fourth of adults reported skipping medical care in 2018 because they were unable to afford the cost.

Addressing out-of-pocket health-related costs

Supplemental insurance policies (e.g., accident, cancer and hospital indemnity) provide an additional layer of financial protection in the case of an accident or illness. These types of policies are not intended as and do not serve as primary major medical coverage or a substitute for such coverage. For this reason, federal and state laws have long recognized these plans as “excepted benefits.” They are generally “excepted” from requirements that apply to major medical coverage, including the ACA requirements.

These types of policies include:

Unlike typical primary medical policies or Medicare, these policies generally pay a cash benefit triggered by a covered accident or illness unrelated to the amount of the expense(s) incurred. This cash benefit is available for any purpose as determined by the policyholder, whether to pay for the out-of-pocket costs that add up even with major medical insurance or for other financial needs.

Conclusion

Regardless of what big or small changes are ahead for our health care system, one reality is that there will always be health-related costs that are not covered by primary medical insurance. Supplemental benefits, including specified disease, critical illness, and hospital indemnity and other fixed indemnity health excepted benefits, are one way individuals can help reduce their exposure to unexpected costs.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and employees and other individuals should consult their own tax or legal advisers about their situation. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.

WWHQ | 1932 Wynnton Road | Columbus, GA 31999.