By Carolyn Smith and John Hickman, Alston & Bird, LLP

Some ‘wellness plan’ arrangements may leave employers and employees not feeling so well

A recent federal-state criminal enforcement action demonstrates the continued commitment of the Department of Labor, or DOL, and other federal agencies to combat fraudulent tax avoidance schemes involving health benefit arrangements. Promoters face the worst consequences; however, employers and employees who innocently participate in these schemes may be held liable for income and employment taxes that should have been paid. This article discusses the recent criminal case and provides guidance to help identify faulty schemes. The article also addresses legitimate plans, including the tax treatment of benefits under traditional fixed indemnity health coverage, such as excepted benefit hospital and other fixed indemnity policies.

DOL and state authorities join forces in prosecuting fraudulent tax scheme

The recent case involves a version of what is commonly referred to as the classic “double dip.” The original double dip first appeared in the early 2000s and consists of two basic steps: First, employees pay for their portion of the cost of an otherwise excludable employer health plan through pretax salary reduction. Next, employees are paid a portion of their salary reduction contribution, purportedly on a tax-free basis, to bring their take-home pay back up to the presalary reduction level. In the original scheme, the payments were characterized by the promoter as “reimbursements” for the cost of the health plan. The promoter pocketed a fee from employers and employees from the purported tax savings. The problem was – and still is – that the purported tax-free payments are in fact taxable wages subject to income and employment taxes and withholding, and the IRS made that clear in Revenue Ruling 2002-3. Subsequent IRS memos addressed more recent variations on this theme.

In the recent case, the promoters collapsed the two steps of the classic double dip into a series of transactions that in effect did nothing more than reduce participants’ taxable wages and related employment taxes, while leaving virtually the same take-home pay. The scheme caused millions of federal FICA and personal income taxes to be underpaid. The only actual money that changed hands was the promoter’s fees paid by employers and employees.

Several regional offices of the DOL, the DOL’s office of inspector general, several state authorities, the IRS criminal investigation division and the FBI participated in the joint investigation. Millions of dollars of assets of the defendants were seized and, under DOL’s ERISA enforcement authority, the defendants were barred from employment, consultation activities and any type of service or position related to employee benefit plans or labor unions for 13 years.

For employers and employees who may be duped into these schemes, the chilling aspect is that, as noted by the DOL, “the employer-clients and employee-participants are now individually responsible” for underpaid employment and income taxes. Penalties on underpayments may be waived by the IRS for employers and employees who were not aware the arrangement was fraudulent, but the amount of unpaid taxes, plus interest, can still be collected. As regulators continue to pursue these unlawful arrangements, employers need to be sure they are dealing with a legitimate plan to avoid unexpected tax liabilities for themselves and their employees.

Recent ‘wellness plan’ tax avoidance schemes: If it looks too good to be true, it probably is

Variations on the classic double dip continue to appear. Many recent schemes are cloaked as part of an otherwise innocuous “wellness plan.” These newer arrangements, marketed primarily to small employers, promise the same “win-win” – tax benefits for both the employer and employees, with no reduction in employee take-home pay. They also have the same fatal flaw – the promised tax benefits are not real.

The IRS addressed various arrangements in a series of memos starting in 2016. The activity around the “wellness plan” tax avoidance schemes appears to have slowed somewhat with the issuance of the IRS guidance, but there are reports that some promoters are still at work. What do the fraudulent schemes look like? Let’s take a look.

Typical promoter claims

Promotional materials may vary, but the promises of tax benefits are similar. Statements that promoters may use to describe the benefits of the arrangement may include claims such as:

Promoters may claim that the plan or materials are proprietary and may ask the employer to sign a nondisclosure agreement. Some arrangements require the purchase of credit life insurance and borrowing.

Core features of the arrangements

Regardless of the terms used to describe these arrangements, they have the same essential core features. To avoid being exactly like the classic double dip, the current “wellness plan” schemes add an additional trigger (“wellness plan” compliance) as the basis for bringing the employee’s pay back up to the presalary reduction level.

Step 1: The employee makes a salary reduction election.

Step 2: Bring the employee’s paycheck back up to the presalary reduction level.

What’s the problem?

The payments in Step 2 are taxable, which reduces the employee’s take-home pay. For the payments in Step 2 to be tax free, the payments must be reimbursements for an incurred medical expense. The activities involved, although perhaps health related, do not involve medical expenses as defined under federal tax rules. Thus, the purported tax savings evaporates.

The payments in Step 2 are taxable, which reduces the employee’s take-home pay. For the payments in Step 2 to be tax free, the payments must be reimbursements for an incurred medical expense. The activities involved, although perhaps health related, do not involve medical expenses as defined under federal tax rules. Thus, the purported tax savings evaporates.

What DOES work?

Using a cafeteria plan to pay for health benefits on a pretax basis, including supplemental fixed indemnity health insurance

It’s straightforward to take advantage of a cafeteria plan so that employees can pay for qualified benefits on a tax-free basis through employee salary reduction. Employee salary reduction amounts may be used to pay for their share of the employer’s major medical plan, dental, or vision coverage and also to pay premiums for supplemental insurance policies, such as specified disease, hospital or other fixed indemnity health policies on a pretax basis. Tax benefits of such pretax arrangements are straightforward and distinguishable from the tax gimmick marketed under “wellness plans.”

The tax treatment of benefits paid under fixed indemnity health polices is well established and depends on whether the premium was paid on an after-tax or pretax basis.

IRS Revenue Ruling 69-154 sets forth the “excess benefit” rule and includes some detailed examples. Under Revenue Ruling 69-154, determining the amount, if any, of taxable benefits under a fixed indemnity health policy paid for with pretax dollars involves a variety of factors which are known only to the employee (and not the employer or insurer). These factors include what other fixed indemnity policies the individual has, the total amount of medical expenses and the amount of reimbursed medical expenses. If the employee has more than one fixed indemnity policy, such as a policy paid with post-tax dollars, the calculation may be more involved, as the employee may need to allocate expenses between the various policies. The employee will make this determination with their tax advisor when filing their personal income taxes for the year in question.

Note that, in one of the memos shutting down abusive “wellness plan” tax schemes (dated Dec. 12, 2016), the IRS inadvertently used some overly broad language that caused confusion about whether the long-standing rule that only “excess benefits” under fixed indemnity health policies are taxable. In a subsequent memo (dated April 24, 2017), the IRS made it clear that nothing had changed with respect to traditional full insured fixed indemnity arrangements. In particular, the April 2017 memo reconfirms the continued validity of Rev. Rul. 69-154.

The April 2017 memo also has a helpful example of a traditional fixed indemnity health plan that pays fixed amounts on the occurrence of health events, such as a medical office visit or a hospital stay where the premiums for the policy are paid on a pretax basis through a cafeteria plan. The plan pays $200 for a medical office visit. If the covered individual’s unreimbursed medical cost as a result of the visit is $30, then $30 is excluded from the employee’s income and the excess amount of $170 is taxable.

Legitimate wellness programs

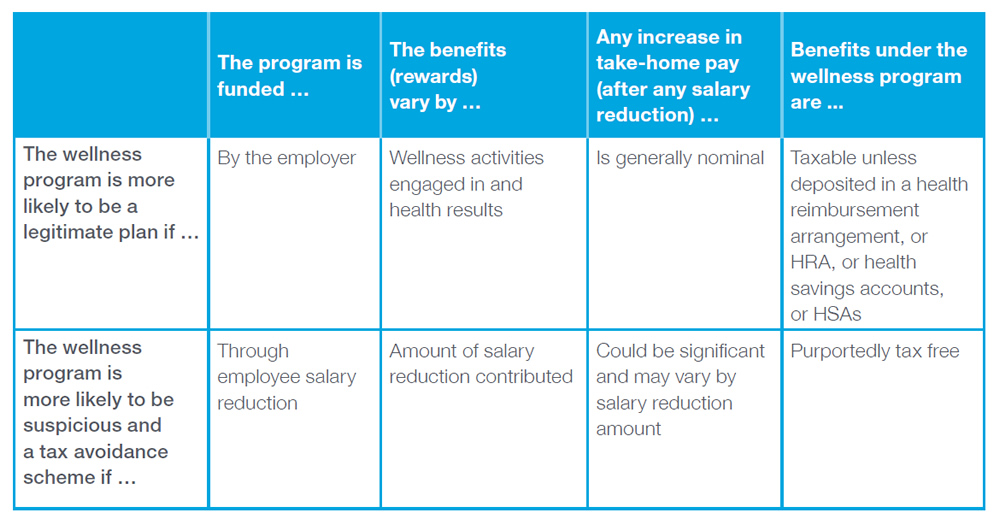

There are many legitimate wellness programs that comply with applicable legal requirements, including the federal tax rules in the Internal Revenue Code, as well as rules from the Department of Labor and the Equal Employment Opportunity Commission that relate to the amount and type of rewards that can be offered under the wellness plan. The following chart provides a high-level guide as to how legitimate wellness programs are structured compared to “wellness plan” tax schemes.

Conclusion

Unfortunately, fraudulent tax avoidance benefits schemes exist. And although federal agencies are working to stop them, it is also important for employers to know what to look for. There is no need for a “wellness plan,” complicated arrangement or signing of a confidentiality agreement to reap the legitimate tax benefits for employer health plans – just a straightforward salary reduction arrangement under Code Section 125. Will there be a reduction in take-home pay? Yes, but there are also real tax savings on the premiums compared to paying on a post-tax basis, and the employee will also receive value in the form of the insurance obtained through the plan.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and employees and other individuals should consult their own tax or legal advisers about their situation. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.