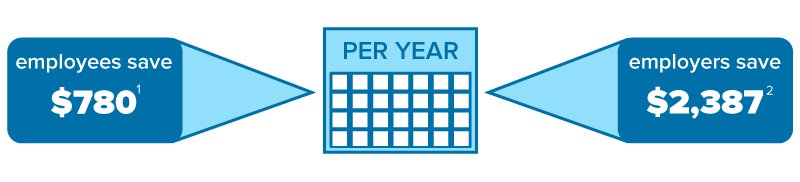

If you pay 10 employees $1,000/week before taxes

And every employee pays 25% income tax and pays $60 per week for their benefits in pretax payroll deductions

All at little to no cost to your business-just by allowing your employees to pay their premiums with pretax dollars.

Companies choose to make Aflac policies available to increase benefits options without impacting their bottom line.

1 Based on a 25% income tax rate on $1,000/week gross payroll, employees would have $705 net pendable income with a $60 pretax benefits contribution, a $15 weekly savings compared with $690 with no pretax benefits contribution. Over 52 weeks, that totals $780 for a year.

2 Based on 10 employees earning $1,000/week gross payroll and a 7.65% FICA employer tax rate, employers whose employees elect $60 weekly in pretax benefits contributions would have $488,800 in taxable payroll ($37,393 tax burden), compared with $520,000 ($39,780 tax burden) for employers whose employees did not elect pretax benefits contributions.

Content within is provided for general informational purposes and is not provided as tax, legal, health or financial advice for any person or for any specific situation. Employers, employees and other individuals should contact their own advisors about their situations.

Individual supplemental insurance coverage is underwritten by American Family Life Assurance Company of Columbus. Group supplemental insurance coverage is underwritten by Continental American Insurance Company (CAIC), a wholly owned subsidiary of Aflac Incorporated. CAIC is not licensed to solicit business in New York, Guam, Puerto Rico or the Virgin Islands. For groups sitused in California, group coverage is underwritten by Continental American Life Insurance Company. For individual coverage in New York or coverage for groups sitused in New York, coverage is underwritten by American Family Life Assurance Company of New York.

WWHQ | 1932 Wynnton Road | Columbus, GA 31999.

Continental American Insurance Company | Columbia SC.

Aflac New York | 22 Corporate Woods Boulevard, Suite 2 | Albany, NY 12211

AGC2301935R2

EXP 1/26